All Post

Building WealthTech Products: Evaluating Brokerage APIs and Infrastructure Options

Investing is no longer a "nice to have." In many countries, it's becoming the only realistic path to a stable retirement. People are living longer, traditional pension systems are under pressure, and in a world shaped by inflation rising costs of living, simply saving money is often not enough.

Some estimates place the global retirement saving gap as high as $400 trillion by 2050. Pause for a second. $400 trillion. Across a global population of 8 billion people, that’s, roughly, $50 thousand per person. Spread over a typical 20–25 year retirement, that’s the equivalent of $170–$210 per month for every retiree. That’s not a rounding error, it’s a systemic problem.

This explains the rapid rise of wealthtech products: robo-advisors (such as Amber), embedded investing inside wallets (like buying crypto inside your everyday wallet), workplace investing (like employer-sponsored plans), micro-investing and cross-border access to global markets.

But there’s a part of this story that doesn’t get enough attention: to democratize investing, you need infrastructure that democratizes access. And that infrastructure starts with brokerage rails for fintech.

The hidden engine behind every investing experience

When people ask what is a brokerage API, they often think of one thing: placing orders.

In reality, modern wealthtech products are powered by full-stack wealthtech infrastructure, built on workflows that include:

Account opening: KYC/KYB, suitability, disclosures, document flows.

Funding: bank linking, transfers, settlement realities, reconciliation.

Trading & portfolio operations: orders, positions, corporate actions, reporting.

Statements & tax docs: which become support tickets if done poorly.

Back-office tooling: admin portals, exception handling, audit trails.

You’re not just integrating an API, you’re designing a system that determines whether users can:

Onboard in minutes or drop off in frustration

Invest small amounts or only "real money"

Trust the product long enough to build long-term wealth

This is where wealthtech infrastructure becomes critical. The right setup depends on your target segment: geography, demographics, investor behavior, and the level of guidance your product promises.

Why is brokerage infrastructure growing so fast

This growth isn’t accidental hype, it’s a response to real demand. The market is signaling it clearly.

For example, Alpaca announced a $150M Series D on January 14th, 2026, focused on scaling brokerage infrastructure globally, explicitly framing the raise as a way to help partners bring investing to more people worldwide.

The underlying drivers are clear for any team thinking about launching embedded investing:

Retirement pressure is increasing globally and people need better long-term outcomes

Users expect mobile-first, real-time experiences (not slow, paperwork-heavy processes)

Fintechs want to embed investing where users already are (wallets, payroll, banking apps)

Platforms want multi-market expansion without rebuilding everything from scratch

Which brings us to the real product question founders ask next: How do I choose the right brokerage infrastructure to build on?

Three brokerage API paths wealthtech teams commonly take

There is no single best option. But there are clear patterns on how to build a wealthtech app, depending on where you plan to operate, and how much control you need.

Below are three common approaches teams evaluate when doing a brokerage API comparison.

1) Alpaca: API-first brokerage infrastructure for embedded investing

Alpaca positions itself as a brokerage infrastructure layer that helps platforms launch investing experiences, supporting 300+ organizations in 40+ countries.

It’s often a good fit if you’re building:

Embedded investing inside a fintech app

A modern brokerage UX where product teams want speed

A scalable API-driven investing module

Our experience: Vangwe is an Alpaca partner and we have built wealthtech mobile apps across different regions using Alpaca-powered infrastructure.

2) Interactive Brokers: deep market access and powerful capabilities

Interactive Brokers represents a different approach: institutional-grade brokerage power with global reach, often chosen when teams need deeper control.

They offer multiple API approaches, including:

TWS API (This is the classic, high-performance route), which is a TCP socket protocol connecting through Trader Workstation.

Web API / Client Portal APIs: browser-based integrations

Good fit when you’re building:

Robo-advisors with robust brokerage foundations

Products where market access, capability and operational depth matter

Platforms willing to handle more complexity in exchange for flexibility

Our experience: We’ve shipped real-world products integrating IBKR across web and mobile, including platforms like Amber.

3) DriveWealth: brokerage-as-a-service for embedded investing

If you want API-driven brokerage-as-a-service with a strong embedded-investing orientation, DriveWealth is another common option teams evaluate.

They describe their platform as API-driven and cloud-based, enabling native investment experiences for partners. They also support fractional purchases on their platform (a practical lever for democratizing access, especially where minimum investment sizes are a barrier).

Good fit when you’re building:

Micro-investing, round-ups, or small-balance onboarding

Embedded investing where fractionals and UX are key

Products expanding to regions where minimum investment size is a core adoption blocker

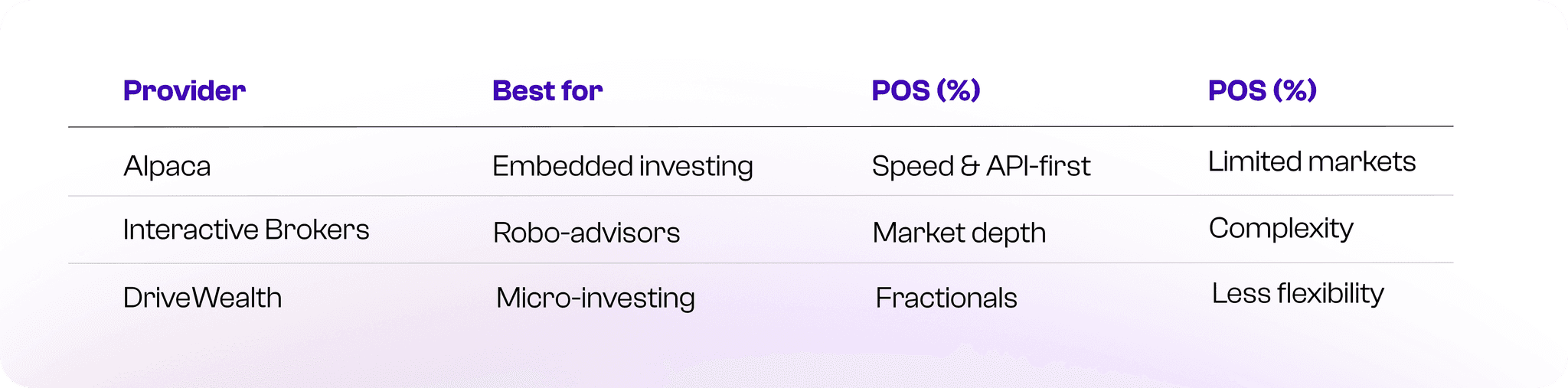

Here's a structured comparison to help clarify which model aligns best with your product vision and operating model:

Common mistakes in wealthtech builds

A short list worth reading twice if you’re thinking about building an investment app backend:

Treating onboarding like a form (it’s a state machine with edge cases)

Ignoring funding and settlement until late (it becomes your top support driver)

Skipping the admin layer (engineers end up doing ops work)

No observability (no event trail = slow debugging + compliance risk)

Choosing rails before defining UX (then UX becomes whatever the provider allows)

Our experience building WealthTech

At Vangwe, we work as a wealthtech development partner for teams building investing products from the ground up, balancing accessibility with institutional-grade reliability, compliance, and scale.

We help founders and product teams:

Choose the right rails for your geography and model

Design the full lifecycle: onboarding → funding → investing → reporting

Ship web, mobile and admin tooling with production-grade operations

If you’re looking for fintech software development for investing, embedded investing development, or brokerage integration services, we bring real-world experience, not just theory.